Embark on a voyage to comprehend the intricacies of foreign exchange analysis. This thorough guide provides you with the essential skills to analyze market trends, spot lucrative scenarios, and strategize your trading approach.

- Understanding the foundations of technical and fundamental analysis to interpreting key indicators, this guide addresses all the crucial aspects of effective forex analysis.

- Cultivate your analytical abilities and acquire a competitive benefit in the dynamic forex market.

Unlocking Profit Potential with Fundamental Forex Analysis

Mastering the foreign exchange sphere requires a deep understanding of core and technical factors. While technical analysis concentrates on price movements and chart patterns, fundamental analysis delves into the underlying economic, political, and social factors that shape currency values. By analyzing these key catalysts, traders can gain valuable insights into potential shifts in the forex market, thereby unlocking profit potential.

- One fundamental aspect of fundamental analysis is evaluating a country's economic health. Key indicators include GDP growth, inflation rates, unemployment figures, and creditor rates.

- Additionally, political stability, government policies, and global events can materially impact currency values. Traders should continue informed about these developments to anticipate potential market movements.

- By conducting thorough fundamental analysis, traders can pinpoint profitable trading opportunities. However, it is important to note that fundamental analysis should be combined with other analytical tools and risk management strategies for a comprehensive approach.

Decoding Market Movements: Technical Analysis for Forex Traders

Navigating the volatile terrain of forex trading demands a keen eye and a tactical approach. Technical analysis emerges as a potent instrument in this endeavor, empowering traders to decipher market movements through past price action. By recognizing recurring patterns and trends, traders can glean valuable clues into potential future price fluctuations.

Charting techniques, such as pivot levels, moving averages, and oscillators, provide a framework for technical analysis. These tools reveal market sentiment, momentum, and potential shifts. While technical analysis is not an infallible forecast, it offers traders a compelling method to enhance their decision-making process and navigate the complexities of the forex market.

Sophisticated Strategies for Successful Forex Trading

Conquering the dynamic Foreign Exchange market demands more than just rudimentary knowledge. To achieve consistent success, traders must implement advanced strategies that leverage market nuances. One crucial aspect is meticulous risk management, employing techniques like trailing stops to mitigate potential deficits. , Moreover, Additionally , mastering technical analysis through chart patterns and indicators can provide valuable insights into price fluctuations.

Remain informed about macroeconomic factors that impact currency pairs, as they can trigger significant market shifts. Developing a robust trading plan that aligns with your risk tolerance and financial aspirations is paramount. Remember, consistent profitability in Forex trading is an ongoing process that necessitates constant learning, adaptation, and belajar trading mudah refinement of your strategies.

Unveiling the Secrets of Forex Analysis: Integrating Fundamentals and Techniques

Successfully navigating the dynamic financial markets demands a sophisticated strategy. Traders who aspire to consistently achieve success must cultivate a comprehensive understanding of both macroeconomic factors and price movements.

Fundamentals provide crucial insights into the strength of economies, shaping currency exchange. Analyzing key indicators such as interest rates, GDP growth, and inflation can expose potential trends in the market.

Complementing this fundamental perspective is the discipline of technical analysis. By studying historical price charts, traders can detect recurring trends that may predict future price direction.

- Combining these two distinct methodologies allows traders to develop a holistic understanding of the market. It empowers them to make more intelligent trading choices.

- By utilizing both fundamental and technical analysis, traders can minimize risk while maximizing their likelihood of achievement.

From Beginner to Expert: Mastering Forex Trading Analysis

Stepping into the dynamic world of forex trading can feel daunting, challenging at first. But with a solid understanding of analysis techniques, you can transform from a novice trader to a skilled market pro. Successful forex trading hinges on your ability to interpret market data and identify profitable trends.

Begin by familiarizing yourself with fundamental analysis, which involves studying economic indicators, news releases and geopolitical factors. This will provide you with a broader context for understanding currency movements. Technical analysis, on the other hand, focuses on past price patterns to predict future movements.

Learning to read charts, identify support and resistance levels, and understand common technical indicators including moving averages and MACD can be invaluable. As you gain experience, consider refining your skills with advanced analysis tools, such as sentiment analysis and Elliott Wave theory. Remember, consistent practice and disciplined execution are crucial for mastering forex trading analysis and achieving long-term growth.

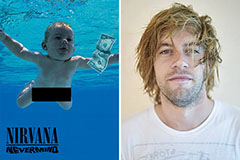

Spencer Elden Then & Now!

Spencer Elden Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Brandy Then & Now!

Brandy Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now!